Public disclosures of supervisory authority - Komisja Nadzoru Finansowego

Solvency II

Public disclosures of supervisory authority

Public disclosures of supervisory authority according to Article 371 of the Act of 11 September 2015 on insurance and reinsurance business, Commission Delegated Regulation (EU) 2015/35 of 10 October 2014 supplementing Directive 2009/138/EC of the European Parliament and of the Council on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II), and Commission Implementing Regulation (EU) 2015/2451 of 2 December 2015 laying down implementing technical standards with regard to the templates and structure of the disclosure of specific information by supervisory authorities in accordance with Directive 2009/138/EC of the European Parliament and of the Council

1. The texts of laws, regulations, administrative rules and general guidance in the field of insurance regulation

2. The supervisory review process (the general criteria and methods, including the tools used in the assessment)

3. Aggregate statistical data pursuant to Article 31 (2) point c) of Directive 2009/138/EC

4. The manner of exercise of the options provided for in Directive 2009/138/WE

5. The objectives of the supervision and its main functions and activities

Texts of laws, regulations, administrative rules and general guidance in the field of insurance regulation

In case of any discrepancies in translation, Polish version of the documents isbinding.

- Act of 11 September 2015 on insurance and reinsurance business

- Ordinance of the Minister of Finance of 2 February 2016 on the minimum scope of data included in a survey on needs of a policyholder or an insured person

- Ordinance of the Minister of Finance of 23 December 2015 on the detailed method of calculating the Basic Solvency Capital Requirement on the basis of the standard formula

- Ordinance of the Minister of Finance of 22 February 2016 on the form and manner of compiling data and information for supervisory purposes by insurance and reinsurance undertakings

- Ordinance of the Minister of Finance of 12 April 2016 on specific accounting principles of insurance and reinsurance undertakings

- Ordinance of the Minister of Finance of 29 April 2016 on additional financial and statistical statements of insurance and reinsurance undertakings

- Ordinance of the Minister of Finance of 16 December 2015 on information included in standard contracts used by an insurance undertaking

- Ordinance of the Minister of Finance of 18 March 2016 on insurance statistics data collected by the Polish Insurance Association

KNF Guidelines and recommendations

Supervisory review process – general criteria, methods and tools

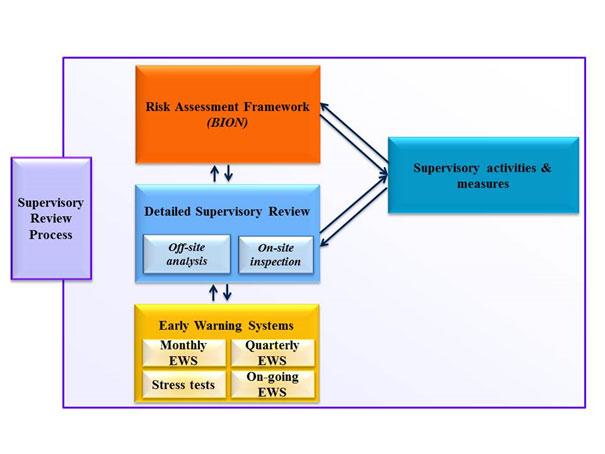

In the Office of the Financial Supervision Authority, the insurance supervision process is carried out using the following tools and activities:

- the Risk Assessment Framework (BION)

- the Early Warning System (EWS)

- the supervisory analysis, including licensing, analytical and inspection activities with reference to individual insurance and reinsurance companies, and analyses related to the insurance sector as a whole, including those related to the financial stability of the sector

- supervisory activities

The Risk Assessment Framework (BION) of insurance and reinsurance companies is a comprehensive process that uses all available information held by the supervisory authority about the insurance/reinsurance company, including information obtained through licensing activities, off site analysis and on-site inspections in the insurance or reinsurance company as well as inquiries/surveys addressed to the insurance or reinsurance company. The concept of the BION of insurance/reinsurance companies developed by the Office of the Polish Financial Supervision Authority is intended to systematise the criteria used to assess the supervised entities so far and introduce elements of the supervisory system based on the assessment of risk identified in their activities.

Methodology of Risk Assessment Framework (BION) for insurance and reinsurance undertakings – 2017

In case of any discrepancies in translation, Polish version of the documents is binding.

The Early Warning System is one of the components of the supervision system based on risk analysis. Monthly, quarterly, annual and ad-hoc data is used within the Early Warning System.

The monthly component allows identification of increased and high capital adequacy risk, financial result risk, business risk on the basis of financial data and information on the technical and financial result received from insurance and reinsurance companies (monthly). The identified risks determine the adoption of appropriate supervisory measures by the supervisory authority, in accordance with the principle of proportionality.

The quarterly component serves quarterly monitoring of the condition of the insurance/reinsurance company and the identification of problems/malfunctioning in the operation of the insurance/reinsurance company. It is based on quarterly information provided by the companies (the analysis covers data from financial and statistical statements as well as statements for supervisory purposes). The results of the analysis have an impact on the supervisory activities undertaken and more effective allocation of resources of the Office of the FSA, which are directed to the areas and entities proportionately to the generated risk and the company's impact on the market.

The annual component is stress testing. It is a quantitative tool for assessing the ability of the insurance or reinsurance company and the insurance sector to bear adverse consequences of events which are extreme, though still likely to occur, or future changes of economic conditions. Stress testing has been carried out by all insurance and reinsurance companies every year since 2009 for risks important from the point of view of the insurance , and additionally some companies are asked to carry out additional stress testing, e.g. for risks specific to a given company or more frequently for risks with the unfavourable results of the annual stress tests. Stress testing is conducted according to the methodology of stress testing established by the supervisory authority and verified annually.

Methodology of Stress tests for insurance and reinsurance undertakings for 2016

1. System of governance, including own risk and solvency assessment

The system of governance, including own risk and solvency assessment , is evaluated as part of analytical and control activities. Moreover, it is subject to regular assessment under the RAF, where the qualitative assessment is carried out, taking into account the specificity of the insurance/reinsurance company, including the legal form (mutual insurance company, joint-stock company), stage of development, scale and profile of activity, distribution channels.

When assessing the system of governance of the insurance and reinsurance company, the supervisory authority takes into account, inter alia, compliance with the requirements of the guidelines and recommendations of the supervisory authority, which were issued in connection with the phenomena observed on the market in the scope of corporate governance, distribution of insurance products, IT systems, outward reinsurance,,flood risk, claims settlement, technical provision and product adequacy.

2. Technical provisions

The purpose of supervision of technical provisions is primarily to ensure compliance by the insurance and reinsurance company with law in establishment and calculation of technical provisions. The area is assessed as part of analytical and control activities.

3. Solvency capital requirement and minimum capital requirement

The purpose of supervision of the solvency capital requirement and the minimum capital requirement is primarily to ensure compliance by the insurance and reinsurance company with solvency requirements. The area is assessed as part of off-site analysis and on-site inspections. In addition, the solvency of the insurance and reinsurance company is verified under BION , and any potential risk of insolvency is assessed under the Early Warning System (i.a. on the basis of monthly data and stress testing).

4. The solvency capital requirement calculated using full or partial internal model

- Application process

According to Article 258(1) of the Act of 11 September 2015 on insurance and reinsurance business, the insurance and reinsurance companies may calculate the solvency capital requirement using full or partial internal model approved, by a way of a decision, by the supervisory authority. Decision is taken within 6 months from the date of receipt of a complete application for approval of an internal model for determining the solvency capital requirement in the so-called application process and includes an assessment of completeness and an assessment of the application's merits. Assessment of the application's completeness consists in the verification whether the documentation submitted with the application includes at least information indicated in Article 2(4) (a)-(r) of Implementing Regulation 2015/460 laying down implementing technical standards with regard to the procedure concerning the approval of an internal model. It is also checked whether all documents indicated in the list of documents and evidence contained in the application, referred to in Article 2(6) of the implementation regulation, have been attached to the application. If the application is deemed complete, the supervisory authority evaluates the merits. While assessing the merits, the supervisory authority verifies whether the internal model submitted for evaluation meets the requirements of Article 258 and Articles 263-268 of the Act of 11 September 2015 on insurance and reinsurance business, and other provisions of Solvency II for internal models, including the Delegated Regulation and implementing regulations.

According to the opinion of the EIOPA (EIOPA-BoS-14/035), in the case of applications for the use of internal models for determining the solvency capital requirement submitted to the Financial Supervision Authority, the FSA recommends insurance and reinsurance companies to attach the so-called unified application package to the application along with other documents. The use of the unified application package form allows arranging the documentation confirming compliance with the requirements of the Act of 11 September 2015 on insurance and reinsurance business, and other provisions of Solvency II for internal models.

Unified application package for internal models: explanatory note

Unified application package for internal models: form

Given the short time to make a decision, the Office of the FSA decided to put in place tools to help insurance and reinsurance companies submit applications with a positive result, including: pre-application processes, the list of critical errors, and comparative study of internal models.

Pre-application process

Conducting pre-application processes, recommended to supervisory authorities in guidelines of the EIOPA (Guidelines on pre-application of internal models and Guidelines on the use of internal models), is a common practice among supervisory authorities from other EU Member States. Participation in pre-application is not a prerequisite for the application process, but, given that it serves a better preparation of the insurance company to the submission of an application to use an internal model for determination of the solvency capital requirement and makes it easier for the supervisory authority to issue a decision on the application on time, it is recommended by the supervisory authority.

The purpose of pre-application is to obtain the supervisory authority's opinion on the preparation of the insurance company for the process of approval of the internal model. During the pre-application process, it is verified whether the internal model submitted for evaluation meets the requirements of Article 258 and Articles 263-268 of the Act of 11 September 2015 on insurance and reinsurance business, and other provisions of Solvency II for internal models, including the delegated regulation and implementing regulations.

Guidelines of the Office of the FSA on starting and organising the pre-application (including the scope of information to be presented in the so-called pre-application package) and the self-assessment form are included in the following documents:

Pre-application package

Self-assessment form

In case of any discrepancies in translation, Polish version of the documents is binding.

Meetings with Members of Management Boards organised for the purpose of the use test are also held within the framework of pre-application of internal models. To this end, the supervisory authority uses a list of issues which are discussed during this type of meetings.

The list of issues for the meetings with Members of the Management Board

The list of critical errors

With the aim of facilitating communication between the supervisory authority and the companies, and within the colleges of supervisory authorities, a list of critical errors has been created. The list of critical errors indicates gaps and errors in models the occurrence of which prevents the supervisory authority from giving a positive decision or opinion on internal models.

List of critical errors in internal models of insurance undertakings

The list of critical errors applies to all internal models, excluding the flood risk models for which the requirements are specified in Guidelines on flood risk management in the insurance sector.

Guideline of the FSA on flood risk management in the insurance sector

- Comparative study of internal models

Comparative study of internal models is a measure recommended in the opinion of the EIOPA (EIOPA-BoS-15/083). Such a study may consist in providing its participants with details necessary to calibrate the models and determine the solvency capital requirement (SCR) for a hypothetical insurance company, which is defined for the purpose of the study. Provided data includes, among others, information on the structure of assets, portfolio of active contracts, damage or policy history of a hypothetical insurance company. On the basis of provided information, participants of the study determine the value of technical provisions for the solvency purpose and solvency capital requirement using methods and models applied, and then submit the results of these calculations to the Office of the FSA together with specified additional information, e.g. scenarios generated by the model.

5. Investment rules

The investment rules are assessed as part of off-site analysis and on-site inspections. Moreover, they are subject to regular assessment under the BION, which includes the quantitative and qualitative assessments of asset management.

6. The quality and amount of eligible own funds

The purpose of supervision of own funds is primarily to ensure compliance by the insurance and reinsurance company with the requirements to the amount of eligible own funds. The area is assessed as part of off site analysis and on site inspections. Moreover, any potential risk of insolvency is assessed under the Early Warning System (i.a. on the basis of monthly data and stress testing).

7. Continuous compliance with the requirements for full and partial internal models (if the insurance or reinsurance company applies a full or partial internal model)

Assessment of continuous compliance with the requirements for full and partial internal models within the supervisory process takes place once the supervisory authority approves the application for using an internal model to determine an individual solvency capital requirement. This assessment includes, inter alia, the indicators analysis based on regular reporting and reports related to exceptional situations. As part of the assessment, the Office of the FSA also admit for comparative study of internal models, participation in comparative studies coordinated by the EIOPA, and other activities, if they can help to determine whether an internal model meets the requirements of Article 258 and Articles 263-268 of the Act of 11 September 2015 on insurance and reinsurance business (Dz. U. of 2015 item 1844) and other provisions of Solvency II related to internal models, including Delegated Regulation and implementing regulations.

The manner of exercise of the options provided for in Directive 2009/138/WE

Supervision objectives, its main functions and activities

1. Supervision objectives

Regulatory objectives

of supervision of the financial market – Article 2 of the Act of 21 July 2006 on supervision of the financial market (consolidated text, Dz.U. 2016, item 174): The purpose of supervision over the financial market shall be to ensure proper operation, stability, security and transparency of the financial market, as well as confidence in that market, and to safeguard the interests of the financial market participants through the reliable information about market operation and through the pursuit of objectives stated in particular in the Banking Law of 29 August 1997, the Act on Insurance and Pension Funds Supervision and the Insurance Ombudsman of 22 May 2003, the Act on Capital Market Supervision of 29 July 2005, the Electronic Payment Instruments Act of 12 September 2002, Act on Supplementary Supervision of Credit Institutions, Insurance Undertakings, Reinsurance Undertakings and Investment Firms in a Financial Conglomerate of 15 April 2005 and the Act on Payment Services of 19 August 2011.

of the insurance market – Article 3 of the Act of 22 May 2003 on insurance and pension funds supervision (consolidated text, Dz.U. 2013, item 290, as amended): The main goal of the supervision activity shall be the protection of interest of insuring persons, insureds, beneficiaries and entitled from insurance contracts, members of pension funds and members of occupational pension programs, persons receiving the capital pension or persons entitled by them.

Specific objectives of supervision of the insurance and reinsurance companies are defined in Article 329(2) of the Act on insurance and reinsurance activity (Dz. U. 2015, item 1844):

The supervision of insurance and reinsurance undertaking shall consist in:

1) protection of interests of policy holders, the insured and beneficiaries under the insurance contracts

2) protection of interests of ceding undertakings and policy holders, the insured and beneficiaries under the reinsured insurance contracts

3) ensuring compliance of insurance and reinsurance undertakings with law, in particular applying to financial management in the following scope:

a) solvency requirements

b) principles of establishing and value of technical provisions for solvency purposes

c) principles of establishing and value of technical provisions for accounting purposes

d) assets

e) amount of eligible own funds

4) granting authorisations for pursuing the insurance or reinsurance business

5) assessment of ability of insurance and insurance undertakings to effectively and efficiently manage the risk under the system of governance of undertaking concerned

6) taking any activities set out in the Act

2. Main functions of supervision

Main functions of insurance supervision include:the license function, i.e., among others, granting permits to conduct insurance and reinsurance business, giving consent to the appointment of two members of the management board of the insurance or reinsurance company (including chairman of the management board and member of the management board responsible for risk management), keeping registers (of actuaries, insurance agents, insurance brokers)

- the control function, i.e., among others, monitoring – through off site analysis or on-site inspections – of the financial and solvency situation of the supervised entities (including their ability to settle liabilities to the insurers, the insured and the entitled under insurance contracts), of changes in ownership structure of supervised entities, of compliance of supervised entities with the law, of relations of supervised entities with the recipients of their services (inter alia, based on information included in documents submitted to the FSA by the recipients of financial services)

- the disciplinary function, i.e. taking preventative or corrective measures, in specific cases using sanctions

- the regulatory function, i.e. determining the expected standards of conducting insurance and reinsurance business, among others, by issuing recommendations to insurance and reinsurance companies

- the educational and informational function, i.e., among others, publication of statistical data and analytical reports on insurance and reinsurance business and the functioning of the insurance market, transferring information on the insurance sector to other entities, the organisation of seminars and training for professional and non-professional financial market participants

- the function of supporting out-of-court dispute resolution – implemented by the creation of the Arbitration Court at the FSA and the Mediation Centre at its disposal, as a platform for out-of-court dispute resolution between financial market participants

3. Main areas of ongoing or planned supervisory activities

Main areas of ongoing or planned supervisory activities with respect to insurance companies, reinsurance companies and insurance groups subject to supervision of the FSA:

- verification of compliance with the solvency requirements, including those related to the amount and quality of eligible own funds and the amount of capital requirements,

- analysis of the principles of establishment and calculation of technical provisions for solvency purposes and technical provisions for accounting purposes,

- verification of valuation of assets and liabilities,

- verification of compliance with the system of governance requirements, including the prudent person principle, the entity's ability to efficiently and effectively manage risk, carrying out own risk and solvency assessment, compliance with statutory requirements by the the key functions holders,

- performance of assessments of the BION for all entities,

- performance of stress testing by all entities and analysis of their results,

- granting permits for conducting the insurance or reinsurance business,

- verification of compliance with the requirements set out in guidelines and recommendations of the supervisory authority through, among others, self-assessment of compliance with the guidelines or on site inspections,

- publication of data and information on the main aspects of the application of prudential supervision, including data on insurance and reinsurance business,

taking other actions specified by the law.

Main areas of ongoing or planned supervisory activities in relation to other entities subject to supervision of the FSA:

- exercising supervision of the activities of insurance agents and insurance brokers and reinsurance brokers,

- keeping registers (of actuaries, insurance agents, insurance brokers).